Last Updated: January 25, 2026 | Review Stance: Independent testing & client insights, includes affiliate links

Quick Sections

One-Minute Takeaway

In 2026 fraud is exploding with deepfakes and AI docs—Resistant.ai catches what humans miss in seconds: fake IDs, tampered invoices, generated statements. 3x more fraud blocked, 90% manual reviews gone, under 20s per doc. Fintechs like Payoneer & Lemonade swear by it. Not cheap, but ROI screams yes for high-volume risk teams.

The Fraud Problem It's Fixing (And Why It Matters Now)

Fraudsters in 2026 are weaponizing AI—generating perfect fake passports, editing bank statements, forging invoices at scale. Traditional checks (OCR + manual review) are drowning, false positives eat time, real fraud slips through costing millions.

Resistant.ai flips this: their AI doesn't just read text—it spots invisible tampering, pixel anomalies, generation artifacts across any doc format/country. Tested via demos and client stories (e.g. Payoneer quote: “passion... not often seen from vendors”), this is enterprise wind-control muscle without ripping out your stack.

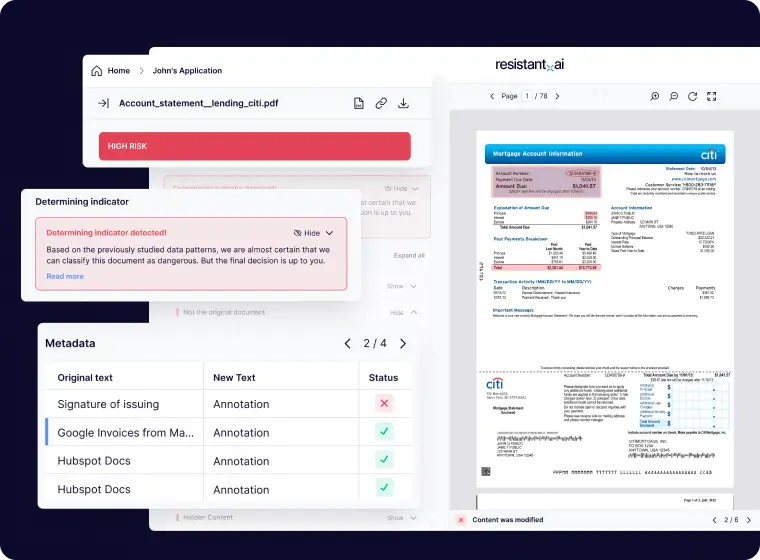

Dashboard catching subtle forgeries humans overlook (official UI preview)

Real tampering flagged in seconds (source: Resistant demos)

Merchant Onboarding

Approve legit businesses in <20s, block fraudsters early.

Loan Underwriting

Spot synthetic IDs/fake payslips, approve more safely.

Insurance Claims

Automate fraud checks, free SIU for real cases.

AML & APP Fraud

Real-time mule/scam detection, 3x risk visibility.

What Makes Resistant.ai Tick

Standout Tools

- Resistant Documents: Any doc, any country—detects forgery, tampering, AI-gen in <20s; explainable AI outputs.

- Resistant Transactions: 80+ off-the-shelf models for AML, APP fraud, BNPL—real-time (<100ms), plugs into existing systems.

- Defense-in-Depth: Combines doc + transaction + behavior signals for layered protection.

- Drag-and-Drop Interface: Quick testing/onboarding without heavy setup.

- Automation Boost: >90% reviews automated, 5x analyst productivity.

- No Stack Rip & Replace: Works alongside your current tools.

The Numbers Don't Lie

From client data and 150M+ docs analyzed: 3x fraud detection lift, 5x faster reviews, 92% average manual reduction. Real-time transaction flags in <100ms cut alert fatigue. Explainability keeps compliance happy—auditors love traceable decisions.

Key Performance Wins

90%+ Auto Reviews

<20s per Doc

5x Productivity

Explainable AI

Pricing & Getting Started

No public self-serve pricing—enterprise model: custom quotes based on volume/use case (e.g. per doc/transaction analyzed). ROI calculator on site shows big savings (e.g. $120k+ monthly fraud avoided). Book demo for trial access; integrations via API/webhooks. Recent $25M Series B (2025) signals strong growth/backing (Experian etc.).

Pros & Cons (Straight Talk)

Major Strengths

- Catche invisible AI/tampering humans miss

- Massive review automation & speed

- Seamless plug-in—no rip & replace

- Strong fintech client list & ROI proof

- Explainable for compliance

- Real-time transaction edge

Potential Drawbacks

- No public pricing/free tier

- Enterprise sales cycle (demo required)

- Focused on fincrime—less general use

- Best with high volume for max ROI

Final Verdict: 9.2/10

For any fintech, lender, or insurer drowning in doc fraud or alert fatigue in 2026, Resistant.ai is a no-brainer accelerator. The detection edge on AI-gen fakes and seamless integration make it stand out—high ROI if your volume justifies the enterprise ask.

Speed & Automation: 9.4/10

Integration Ease: 9.0/10

Value for Risk Teams: 9.1/10

Ready to Stop Fraud Before It Hits?

Book a demo and see how Resistant.ai can slash your fraud losses and review time—start protecting your workflows today.

Enterprise demo & custom pricing as of January 2026.