- Home

- Industry Trends

AI News and Information

Over 3,000 Best AI Products and Services, Updated Daily...

Indonesia Temporarily Blocks xAI's Grok: First Country to Ban Access Over Non-Consensual Sexualized Deepfakes Crisis

On January 10, 2026, Indonesia became the world's first country to impose a temporary nationwide block on xAI's Grok chatbot. The decision, announced by Communications and Digital Minister Meutya Hafid, cites the severe risk of AI-generated pornographic and non-consensual deepfake content — including sexualized images of real women, minors, and depictions of abuse — produced via Grok's image generation tools. This aggressive move follows global backlash, with xAI recently restricting image features to paying subscribers only, yet failing to satisfy regulators. Indonesia's action marks a major escalation in AI content governance, highlighting tensions between uncensored AI design and national digital morality standards.

How to Build a $4,000+/Month AI Agent Agency in 2026 Using Relevance AI + Voiceflow for Custom Chat & Voice Solutions Sold on Gumroad

Businesses crave custom AI agents for support, sales, lead gen, and automation—but building them requires expertise. This creates a high-margin agency niche: use Relevance AI (for multi-agent workflows & ops automation) combined with Voiceflow (for no-code chat/voice agents). Package & sell ready-to-deploy templates or custom builds on Gumroad as digital products. This guide shows launching a “Done-for-You/Custom AI Agent Agency,” delivering retainers + one-time Gumroad sales for recurring/passive income in the 2026 AI agent boom.

MiniMax Goes Public on HKEX: Raises Over HK$5 Billion in Record 4-Year IPO Sprint, Shares Surge 50% on Debut Day

On January 8, 2026, Chinese AI unicorn MiniMax made history with its blockbuster Hong Kong IPO, raising more than HK$5 billion (≈US$640 million) — the fastest path from founding to public listing among major Chinese AI companies in just four years. Priced at the top of the range, the stock (ticker: 9898.HK) opened 38% higher and closed up 50% on debut, valuing the company at over HK$45 billion. The explosive first-day performance reflects surging global appetite for frontier AI infrastructure plays and cements MiniMax as the hottest AI IPO of the post-ChatGPT era.

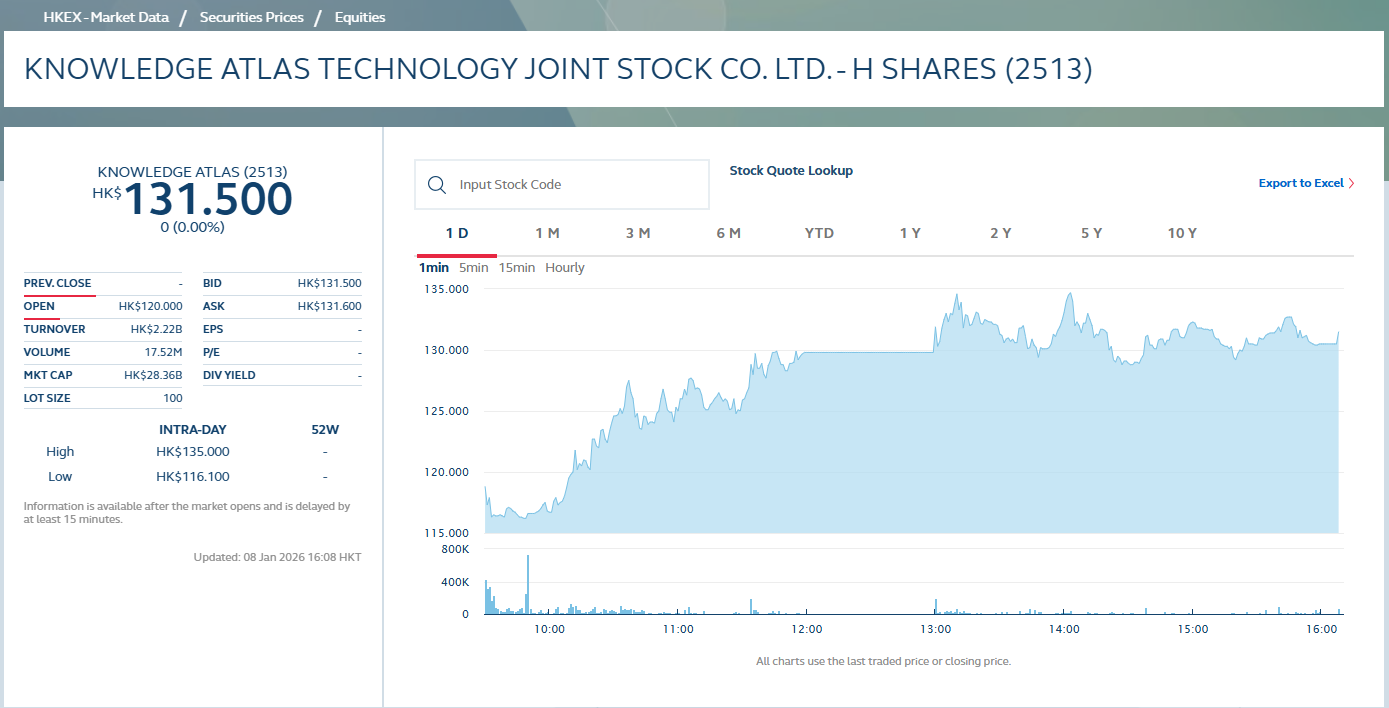

Zhipu AI (智谱) Rocks Hong Kong Debut: Stock Surges 13%+ on Day One, Market Cap Breaks HK$570B, Leading China's Domestic LLM Commercialization Charge

On January 8, 2026, Zhipu AI (stock code: 02513.HK), hailed as the world's first pure-play AGI foundation model company, made a blockbuster debut on the Hong Kong Stock Exchange. Priced at HK$116.20 per share, the stock opened at HK$120, dipped briefly, then rallied to close up 13.17% at HK$131.50 — pushing market cap to HK$578.9 billion. Backed by massive oversubscription (Hong Kong tranche 1159x), star base investors, and blockbuster 2025 revenue exceeding US$100M, Zhipu solidifies its lead in China's independent LLM commercialization race, outpacing peers in API scale, developer ecosystem, and enterprise adoption.

Arm Establishes Dedicated Physical AI Division: A Strategic Pivot to Own the AI Hardware Stack from Silicon to Embodied Intelligence

On January 8, 2026, Arm officially announced the creation of its new “Physical AI Division” — a dedicated organization focused on accelerating embodied AI, robotics, and edge intelligence across Arm-based silicon. Led by former Google DeepMind robotics lead, the division will integrate Arm’s CPU/GPU/NPU architecture with real-world physical simulation, sensor fusion, and low-latency inference frameworks. The move positions Arm as the foundational compute platform for the next wave of physical AI — from humanoid robots and autonomous drones to industrial cobots — directly challenging NVIDIA’s dominance in training while claiming the edge/embodied crown.

xAI Oversubscribes Series E: Closes $20 Billion Mega-Round, Fueling Colossus Expansion and Grok 5 Acceleration

On January 6, 2026, xAI announced the successful close of its upsized Series E funding round, raising a staggering $20 billion — far exceeding the initial $15 billion target. Backed by heavyweights including NVIDIA, Cisco Investments, Valor Equity Partners, Fidelity, and the Qatar Investment Authority, this capital injection propels xAI's valuation to approximately $230 billion. The funds will supercharge the world's largest GPU clusters (Colossus I & II now exceeding 1 million H100 equivalents) and fast-track Grok 5 development, as investor frenzy in frontier AI reaches fever pitch.

Zhipu AI Makes History: World's First AGI Base Model Company Lists on HKEX as 02513.HK, Surging 13% on Debut

On January 8, 2026, Beijing Zhipu Huazhang Technology (Zhipu AI) officially debuted on the Hong Kong Stock Exchange under ticker 02513.HK — becoming the world's first publicly listed company with AGI base models as its core business. Priced at HK$116.20 per share, it opened at HK$120 and closed at HK$131.5, up 13.17%, pushing market cap to approximately HK$579 billion. The IPO raised HK$4.35 billion amid 1,159x oversubscription, marking a watershed moment for China's AI industry and igniting global capital frenzy around frontier large models.

Build a $4,000+/Month Viral Video Agency in 2026: Master TikTok with Lumen5 & Descript

In 2026, TikTok's algorithm demands a relentless stream of high-quality, native-feeling vertical videos. But creating them—especially adding trending audio, precise captions, and dynamic text—is a complex bottleneck for creators and brands. This guide unveils a powerful agency model: combine Lumen5 for rapid, eye-catching text-on-screen visuals, Descript for professional-grade audio editing and viral sound syncing, and deep TikTok strategy. Learn how to offer an end-to-end TikTok video service that delivers not just content, but real platform growth, turning the chaos of trends into a predictable revenue stream.

Moonshot AI Secures $500M Series C at $4.3B Valuation: IDG Leads, Alibaba & Tencent Oversubscribe, Fueling 2026 Multimodal Breakthrough

On December 31, 2025, Beijing-based Moonshot AI — creator of the breakout Kimi chatbot — closed an oversubscribed $500 million Series C round led by IDG Capital ($150M commitment), with heavy participation from existing giants Alibaba, Tencent, and Meituan co-founder Wang Huiwen. The deal catapults the company's post-money valuation to $4.3 billion and bolsters cash reserves beyond $1.4 billion. Founder Yang Zhilin revealed aggressive plans to scale GPU infrastructure and accelerate the K3 model, targeting global frontier multimodal capabilities by early 2026 amid explosive 170% MoM paid user growth.

Satya Nadella's 2026 AI Manifesto: Microsoft CEO Calls for Shift from "Model-Driven" to "System-Driven" Era, Betting Everything on Copilot Agents

On January 2, 2026, Microsoft CEO Satya Nadella launched his personal blog "sn scratchpad" with a pivotal post declaring 2026 the turning point for AI. He urges the industry to move beyond debates over "AI slop" vs. sophistication and isolated models, toward engineered "systems" that orchestrate multiple agents with memory, tools, and entitlements. Nadella positions Copilot as the future core of productivity—evolving from assistant to persistent digital worker—while emphasizing AI as human amplification, societal impact, and real-world value over spectacle.

Global AI Safety Alliance (AISA) Launched: 20 Leading Companies Including Google, OpenAI, and Alibaba Unite to Establish Universal AI Safety Standards

On December 18, 2025, the Global AI Safety Alliance (AISA) was officially established, bringing together over 20 frontier AI developers from the US, China, Europe, and beyond—including Google DeepMind, OpenAI, Alibaba Cloud, Anthropic, Meta, xAI, DeepSeek, Zhipu AI, and Tencent. The alliance commits to co-developing shared risk thresholds, open-source safety tools, and transparent evaluation frameworks for advanced AI systems. This landmark cross-border initiative aims to harmonize global standards amid escalating regulatory pressures, marking the first truly multinational industry-led effort to mitigate catastrophic AI risks.

SoftBank Completes $22.5 Billion Additional Investment in OpenAI: Masayoshi Son's All-In AI Bet Pays Off with 11% Stake

On December 26, 2025, SoftBank Group officially completed its promised $22.5 billion additional investment in OpenAI, fulfilling a March commitment for up to $40 billion total (including co-investors). This massive cash infusion — routed through Vision Fund 2 — elevates SoftBank's stake to approximately 11%, making it OpenAI's second-largest investor behind Microsoft. Amid soaring AI infrastructure costs and OpenAI's push toward AGI, this deal underscores Son's aggressive pivot, achieved through asset sales, loans against Arm shares, and ruthless portfolio pruning.

Site Search

AI News

RankSense + SurferSEO: The “Dev‑Queue Bypass” (Fix Technical SEO at the Edge & Optimize Content for Results)

01/31/2026

How to Build a $6,000+/Month Premium AI Visual Design Agency Using MidJourney for Brands & Creators

12/25/2025

How to Build a $4,500+/Month AI Product Video Agency for Shopify Stores in 2026 Using HeyGen + PlayHT

01/13/2026

“Video Repurposing Line”: Turn One Topic into 10 Short Videos with VidFlux + HeyGen (Without Looking Cheap)

01/31/2026

Meta Unveils WorldGen: Revolutionary Text-to-3D System Generates Fully Explorable 50×50 Meter Interactive Worlds

12/30/2025

X-VPN Review 2026 – Freemium VPN with Unlimited Free Tier & Streaming Focus?

12/27/2025

How to Build a $4,500+/Month AI Interactive Explainer Agency in 2026 Using Mootion + Voiceflow for Upwork Clients & Brands

01/15/2026